Chandigarh

24 June 2017

DIVYA AZAD

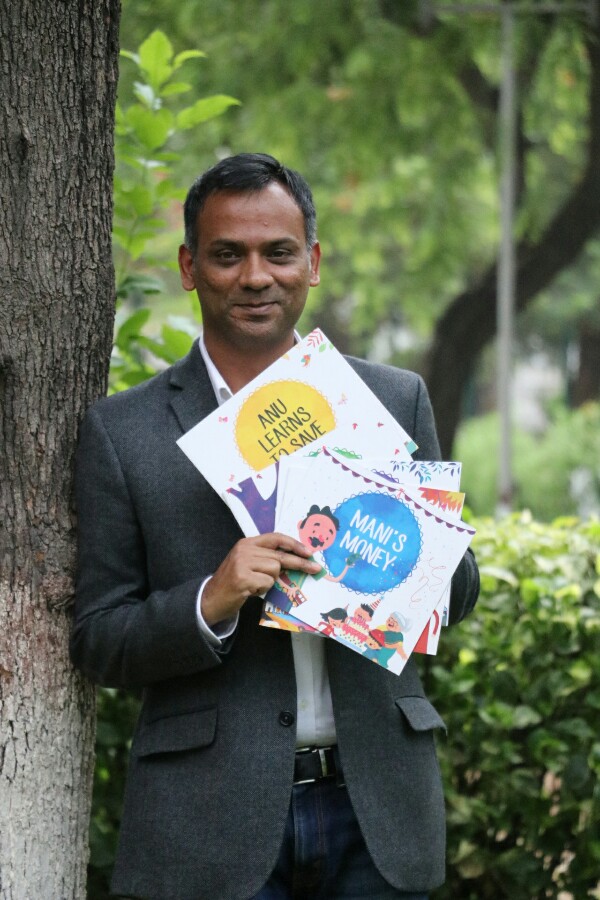

Small children are usually not aware of Finance topics and find it hard to understand. The demand of changing time is to educate children about even small happenings around them. Zerodha, India’s leading technology-driven brokerage firm has come up with unique idea to nuture young minds with basic financial concepts. Zerodha launched The Rupee Tales- a set of 5 story books which attempts to educate children above 7 years on Wednesday in Press Club Chandigarh.

Speaking on the occasion, Karthik Rangappa, the author of Rupee Tales & VP- Educational Services, Zerodha, said we used illustrations and small stories to provide extra knowledge to young ones. The idea to write Rupee tales came up when my 7 year old daughter kept asking me where I work and what I do. It was not easy to explain her what the stock market is. During a casual chat at work, we realised there is no material available for kids to educate them on finance concepts.

It is part fictional and part real life stories based in different cities of India. We have used cartoons to create interest of small kids and also this is a tribute to famous cartoonist from Goa. Our basic aim is to promote Financial literacy. The Rupee tales box set can be ordered from http://rupeetales.com , is priced at INR 470/- only said Karthik.

Speaking on the development, Nithin Kamath, Founder & CEO said, “Zerodha is committed to improving financial literacy in India. Our educational initiatives, such as Varsity and Trading Q&A are a testimony to this. We are taking this commitment further with Rupee Tales. It is our earnest attempt to creatively inculcate basic financial awareness among children. The concepts covered in Rupee Tales pertain to financial inclusion; pivotal to the cashless and paperless economy India is striving for. A large part of the ‘financial inclusion for all’ dream is dependent on how the younger generation adapts to it.”

Each book deals with a specific topic, peppered with lively characters and vibrant illustrations by Tarun Andrews.

The Cake Shop

8 year old Abhay gets angry when his friends jokingly suspects Abhay’s father working as a smuggler. He ask his mother Vidya about his father’s occupation and to help him understand she takes him to a cake shop. The story is about STOCK MARKET.

Mani’s Money

Mani, a hard working cook, helped few families prepare their daily meals. He used to like Dadi’s family the most. One day he realizes that his money which he left under the bed is no longer safe. Dadi then helps him safeguard his money. The story explains the need to deposit money in a savings account.

Vishrambu’s Bus Journey

Vishrambu, Bank Manager Sharmaji’s son, was one of the most mischievous boys in Banaras. He used to create lot of trouble and destroy things making sharmaji pay for the damages. One day they embark on bus journey and an incident occurs which changes Vishrambu forever. The story talks about how a responsible citizen pays his share of taxes to the government.

One and a Half Stories

Tara wants her mother Janaki to read her story before going to bed. The story Tara chooses is quite long. Her mother convince her that she would read only half the story and the other half the next day. As the story unfolds, Tara understands a very important real life concept. This story introduces the concept of Insurance.

Anu learns to Save

Two little Best Friends Annie and Anu from Goa used to help people. One day while helping Michael the milkman to carry milk to the market, they accidentally spilt all the milk. Annie suddenly realizes how she could help Uncle Michael. Meanwhile, Anu learns a very important lesson from Annie. This simple story explains the importance of saving money regularly from a very early age.

ZERODHA LAUNCHES INDIA’S FIRST DIRECT MUTUAL FUND & EQUITY PLATFORM – COIN

Zerodha Coin is a platform that let the customer buy mutual funds online, completely commission-free, directly from asset management companies. The mutual fund bought through Coin will be in demat form, with a convenience of one portfolio across equity, mutual fund, currency. Zerodha will charge a flat subscription fee of Rs 50 per month, irrespective of the number or value of mutual fund transactions. One can start, stop or modify SIPs anytime they want and the first Rs 25,000/- worth of investments would be free.

“For an informed investor, buying mutual funds directly is the best option. SIP of Rs 5000 monthly invested for 25 years in direct vs distributor can potentially save Rs 28 lakh as commissions. Buying direct mutual fund in demat also gives the convenience of a single portfolio view,” Nithin added.

To manage the growing needs of its clients, Zerodha currently has 22 branches, 70 partner offices and 5support/call & trade offices in India.